What happened on 7th June 2023 - with your comments in the Web

The first Wednesday news became political and Russian scandal. Tory were happy to know that their donor's amusement centre in Hastings received with £150,000 levelling up grant.

A £150,000 grant from Boris Johnson’s flagship levelling up towns fund was awarded to an amusement centre launched by the Conservative donor Lubov Chernukhin, raising questions about whether public money has gone to projects most in need of financial help.

Chernukhin, a businesswoman who has given more than £2m to the Conservatives since 2014 and is married to a former Russian finance minister, co-founded the Owens entertainment centre in Hastings, East Sussex.

The centre received £150,000 from the government’s towns fund in October after a tender process, through a company called C&O Entertainment. A further £250,000 went to the developer behind the refurbishment of the former Debenhams building in the seaside town. It includes several restaurants, a bowling alley, immersive experiences, virtual reality rides, an oddity museum and amusement arcade. There is no suggestion of any political consideration in the award of the grant.

"This has to be the most corrupt government we've ever had. Literally taking money out of our pockets and sending it to their mates."

"Their mate being a Russian born former investment banker and the largest female political donor ever." - "To quote lots of people on Twitter: Where's the Russia Report?!"

"Isn't she the main conduit for Kremlyn money flooding into the Tory party? Tories claim she no longer has any dealings with Russia, but the Panama papers showed she still has close links to high-level figures in the Russian Government."

"I’m not really shocked anymore. Everyone in government should be put on trial, along with everyone in Johnson’s government too, way too corrupt. Actually the exception to that would be Ben Wallace."

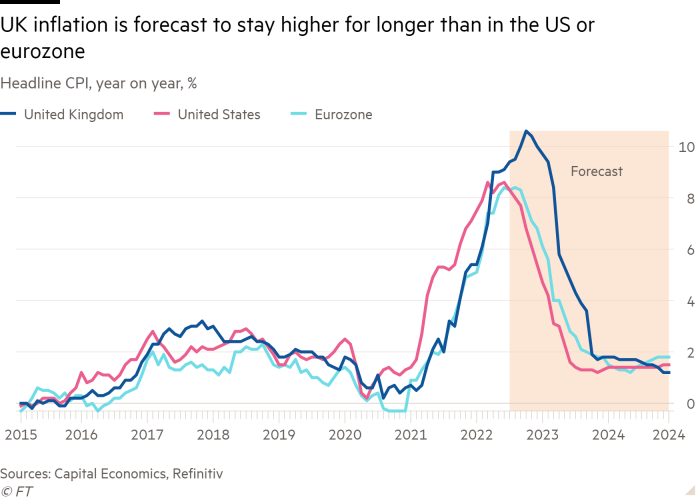

Another bitter inflation news came on Wednesday. The UK to have one of highest inflation rates in G20 this year, new forecast shows.

Britain will have one of the highest inflation rates in the G20 this year but should narrowly avoid recession, the Organisation for Economic Co-operation and Development (OECD) has said in its latest set of forecasts. The Paris-based OECD - a club of rich countries - said UK inflation will be higher in 2023 than nearly any G20 member save for Argentina and Turkey.

However, looking at its broader membership, the UK's inflation rate, while high, will be outpaced by a number of other countries, including Sweden and Iceland. It warned that higher interest rates are likely to dampen economic growth and incomes in the coming months.

"Woo-hoo - we're Number one, I'm so glad our Government is keeping these records coming to the UK..."

"BREXXIITTT!!!!! UK NUMBER 1

THANKS FARAGE, BOJO AND JACOB REES MOGG

BLUE PASSPORTS NUMBER 1!!

BREXXIITTT!!!"

"Blue Passports woohooo!!! ….Someone remind me please where does UK order them from?"

"Can't be, I remember that nice man on the television saying he was going to halve inflation"

Also on Wednesday, Brits learned about new rules for banks. Under new laws, banks will be forced to reimburse victims of fraud within five days.

New rules will require banks to give victims their money back within one working week, apart from in cases of gross negligence or where supposed victims are found to have played a role in the fraud.

Currently scam refunds are paid in line with a voluntary code of guidelines, but not all banks are signed up and fewer than half of victims get their money back.

The cost of the mandatory reimbursement will be split 50:50 between the firms sending and receiving the payment, so that all banks and building societies will be incentivised to take preventative action on “APP” scams, the Payment Systems Regulator, which has been consulting on the new measures, said.

"There are many cases in the news of people being repeatedly warned by the bank that their requested transaction was probably fraudulent, but they go ahead anyway...and again...and again.

Then they write to the Daily Mail complaining that the bank isn't refunding them. Under the duress of bad publicity, the bank often refunds them.

Do people bear no responsibility for their actions? Looking at the list of potentially fraudulent transactions, I have no problem with transactions on stolen cards being refunded but not such much where the person was tricked into sending money.

Anyway, we're all paying for it with bank charges of various kinds."

"For every payment I try and make via NatWest it tells me it could be fraudulent. Then gives me a multiple choice of options to let them know where my money is going. Then a final box to tick acknowledging it’s my fault if my money goes.

I don’t see that as helpful, just annoying. It’s not specific or targeted, it’s just a blanket “covering our arse”"

"Makes me scared to make legit payments sometimes. It's like going through security, and suddenly thinking someone's planted drugs on you or something."

"All this really means is more hoops to jump through for those who are careful in the first place to protect those who are frankly, negligent in managing their finances.

I'm all for enforcing refunds in genuine cases, it shouldn't be discretionary for banks. But what this will mean in reality is they will make it more hassle to send, receive or spend money in order to limit their liabilities.

It's already a ball-ache as it is, having to receive loads of OTP, do biometric scans, tell the bank you have understood the nature of the transaction etc.

This strikes me as more red-meat for the more ignorant members of society who, despite decades of warnings, endless notifications, prompts, tv shows, news articles and the like, still just go ahead with sending money in ridiculous circumstances.

If the legislation that enables this also ensures that financial institutions do not make life more onerous for the rest of us, it can't be bad. But it never works out that way.

"

.jpg)

Comments

Post a Comment